Cintas Corporation Announces Fiscal 2017 Second Quarter Results

CINCINNATI - December 22, 2016 - Cintas Corporation (Nasdaq: CTAS) today reported results for its second quarter of fiscal year 2017 which ended November 30, 2016. Revenue for the second quarter was $1.30 billion, an increase of 6.4% over last year’s second quarter. The organic growth rate, which adjusts for the impacts of acquisitions and foreign currency exchange rate fluctuations, was 5.7%. Organic growth for the Uniform Rental and Facility Services segment accelerated to a rate of 6.5%.

Second quarter gross margin improved to 44.1% from 43.3% last year. Scott D. Farmer, Cintas’ Chairman and Chief Executive Officer, stated, “This is our 13th consecutive quarter of year-over-year gross margin improvement. This, along with our industry leading organic sales growth, is a reflection of the significant opportunities that exist for us and of the great execution of our employees, whom we call partners.” Gross margin of the Uniform Rental and Facility Services segment improved to 44.7%, an increase of 80 basis points compared to last year’s second quarter. The First Aid and Safety segment gross margin improved to 46.1%, representing both a year-over-year and sequential increase of 290 and 30 basis points, respectively, due to the realization of synergies from the acquisition of ZEE Medical in fiscal 2016.

Selling and administrative expenses as a percentage of revenue were 28.2% in the second quarter compared to 26.8% in last year’s second quarter. The increase was the result of strategic investments in a new enterprise resource planning system, in our national branding campaign (Ready for the Workday®), and in sales resources to grow recently acquired customers in our First Aid and Safety segment, as well as a 70 basis point increase in medical expenses.

Operating income for the second quarter of $203 million increased 1.3% from last year’s second quarter. Operating income margin was 15.6% compared to 16.4% in last year’s second quarter. Second quarter operating income included $3.3 million, or 0.3% of second quarter revenue, of transaction expenses related to the previously announced agreement to acquire G&K Services, Inc. (G&K).

Net income from continuing operations for the second quarter was $123 million compared to $115 million in last year’s second quarter. Earnings per diluted share (EPS) from continuing operations for the second quarter were $1.13 which included a negative $0.02 impact from G&K transaction expenses, compared to $1.03 in last year’s second quarter. Second quarter net income and EPS from continuing operations increased 6.9% and 9.7%, respectively, compared to last year’s second quarter. Excluding the negative impact of the G&K transaction expenses, second quarter net income and EPS from continuing operations increased 8.8% and 11.7%, respectively, compared to last year’s second quarter, and net income margin from continuing operations improved to 9.7% compared to 9.5% in last year’s second quarter.

Mr. Farmer added, “Earlier this month, on December 2nd, we demonstrated our commitment to increasing shareholder value by paying an annual dividend of $1.33 per share, an increase of 26.7% over last year’s annual dividend. We have increased this dividend for 33 consecutive years, which is every year since we went public in 1983.”

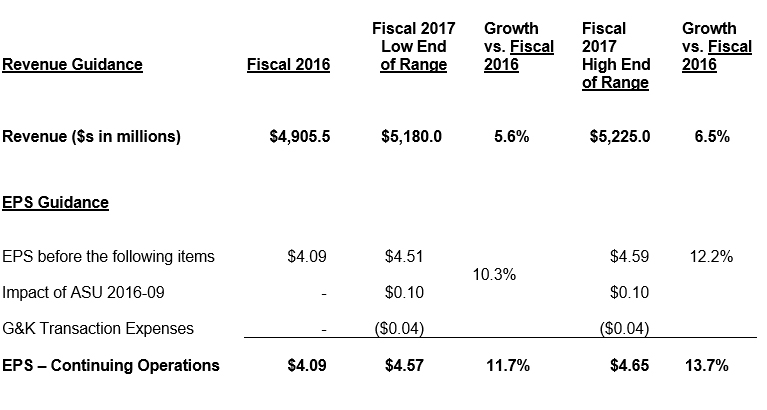

Mr. Farmer concluded, “We are updating our annual guidance. We expect fiscal 2017 revenue to be in the range of $5.180 billion to $5.225 billion and fiscal 2017 EPS from continuing operations to be in the range of $4.57 to $4.65. This guidance does not include any future financial impact from our acquisition of G&K, including transaction expenses. It does include the impact of one less workday in fiscal 2017 compared to fiscal 2016. Our solid second quarter results, along with our updated guidance, position us to achieve record revenue and to grow our EPS double-digits for a seventh consecutive year. I thank our partners for continuing to deliver best in class results.”

The table below provides a comparison of fiscal 2016 revenue and EPS from continuing operations to our fiscal 2017 guidance.

About Cintas Corporation

Cintas Corporation helps more than 900,000 businesses of all types and sizes get Ready™ to open their doors with confidence every day by providing a wide range of products and services that enhance our customers’ image and help keep their facilities and employees clean, safe and looking their best. With products and services including uniforms, floor care, restroom supplies, first aid and safety products, fire extinguishers and testing, and safety and compliance training, Cintas helps customers get Ready for the Workday. Headquartered in Cincinnati, Cintas is a publicly held company traded over the Nasdaq Global Select Market under the symbol CTAS and is a component of both the Standard & Poor’s 500 Index and the Nasdaq-100 Index.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements. Forward-looking statements may be identified by words such as “estimates,” “anticipates,” “predicts,” “projects,” “plans,” “expects,” “intends,” “target,” “forecast,” “believes,” “seeks,” “could,” “should,” “may” and “will” or the negative versions thereof and similar words, terms and expressions and by the context in which they are used. Such statements are based upon current expectations of Cintas and speak only as of the date made. You should not place undue reliance on any forward-looking statement. We cannot guarantee that any forward-looking statement will be realized. These statements are subject to various risks, uncertainties, potentially inaccurate assumptions and other factors that could cause actual results to differ from those set forth in or implied by this Press Release. Factors that might cause such a difference include, but are not limited to, the possibility that the closing conditions to the proposed merger of G&K Services, Inc., or G&K, with a wholly owned subsidiary of Cintas, which we refer to as the transaction, may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval; delay in closing the transaction or the possibility of non-consummation of the transaction; the potential for regulatory authorities to require divestitures in connection with the proposed transaction; the occurrence of any event that could give rise to termination of the merger agreement; the risk that stockholder litigation in connection with the transaction may affect the timing or occurrence of the transaction or result in significant costs of defense, indemnification and liability; risks inherent in the achievement of cost synergies and the timing thereof, including whether the transaction will be accretive and within the expected timeframe; risks related to the disruption of the transaction to G&K and its management; the effect of announcement of the transaction on G&K’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other third parties; our ability to promptly and effectively integrate acquisitions, including G&K and ZEE Medical; the possibility of greater than anticipated operating costs including energy and fuel costs; lower sales volumes; loss of customers due to outsourcing trends; the performance and costs of integration of acquisitions, including G&K and ZEE Medical; fluctuations in costs of materials and labor including increased medical costs; costs and possible effects of union organizing activities; failure to comply with government regulations concerning employment discrimination, employee pay and benefits and employee health and safety; the effect on operations of exchange rate fluctuations, tariffs and other political, economic and regulatory risks; uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation; the cost, results and ongoing assessment of internal controls for financial reporting required by the Sarbanes-Oxley Act of 2002; costs of our SAP system implementation; disruptions caused by the inaccessibility of computer systems data, including cybersecurity risks; the initiation or outcome of litigation, investigations or other proceedings; higher assumed sourcing or distribution costs of products; the disruption of operations from catastrophic or extraordinary events; the amount and timing of repurchases of our common stock, if any; changes in federal and state tax and labor laws; and the reactions of competitors in terms of price and service. Cintas undertakes no obligation to publicly release any revisions to any forward-looking statements or to otherwise update any forward-looking statements whether as a result of new information or to reflect events, circumstances or any other unanticipated developments arising after the date on which such statements are made. A further list and description of risks, uncertainties and other matters can be found in our Annual Report on Form 10-K for the year ended May 31, 2016 and in our reports on Forms 10-Q and 8-K. The risks and uncertainties described herein are not the only ones we may face. Additional risks and uncertainties presently not known to us or that we currently believe to be immaterial may also harm our business.

For additional information, contact:

J. Michael Hansen, Senior Vice President-Finance and Chief Financial Officer – 513-701-2079

Paul F. Adler, Vice President and Treasurer – 513-573-4195