Cintas Corporation Announces Fiscal 2023 Third Quarter Results

CINCINNATI - March 29, 2023 - Cintas Corporation (Nasdaq: CTAS) today reported results for its fiscal 2023 third quarter ended February 28, 2023. Revenue for the third quarter of fiscal 2023 was $2.19 billion compared to $1.96 billion in last year’s third quarter, an increase of 11.7%. The organic revenue growth rate for the third quarter of fiscal 2023, which adjusts for the impacts of acquisitions and foreign currency exchange rate fluctuations, was 11.8%.

Gross margin for the third quarter of fiscal 2023 was $1,034.0 million compared to $898.2 million in last year’s third quarter, an increase of 15.1%. Gross margin as a percentage of revenue was 47.2% for the third quarter of fiscal 2023 compared to 45.8% in last year's third quarter, an increase of 140 basis points. Energy expenses comprised of gasoline, natural gas and electricity were 15 basis points lower for the third quarter of fiscal 2023 compared to last year's third quarter.

Operating income for the third quarter of fiscal 2023 was $446.8 million compared to $407.6 million in last year's third quarter. Operating income as a percentage of revenue was 20.4% in the third quarter of fiscal 2023 compared to 20.8% in last year's third quarter. Fiscal 2022 third quarter operating income included a $30.2 million gain on an equity method investment transaction. The gain was recorded in selling and administrative expenses. Excluding this gain, fiscal 2023 third quarter operating income as a percentage of revenue of 20.4% compared to 19.3% in last year's third quarter, an increase of 110 basis points.

Net income was $325.8 million for the third quarter of fiscal 2023 compared to $315.4 million in last year's third quarter. Third quarter of fiscal 2023 diluted earnings per share (EPS) was $3.14 compared to $2.97 in last year's third quarter. Fiscal 2022 third quarter diluted EPS contained $0.28 from the gain on an equity method investment transaction, which included a related $0.07 tax rate benefit. Excluding this gain and the related tax benefit, fiscal 2023 third quarter diluted EPS of $3.14 compared to $2.69 in last year's third quarter, an increase of 16.7%.

On December 15, 2022, Cintas paid an aggregate quarterly cash dividend of $117.4 million to shareholders, an increase of 18.6% from the amount paid last December.

Todd M. Schneider, Cintas' President and Chief Executive Officer, stated, "Our financial performance is the result of the exceptional dedication of our employee-partners to helping businesses across North America with their image, safety, cleanliness and compliance. Through innovative solutions and routine service visits, our employee-partners take care of the important tasks that help our customers keep their workplaces running smoothly. This enables our customers to have more time to focus on their business."

Mr. Schneider continued, "Our operating segments continue to execute at a high level. Strong volume growth from new customers and the penetration of existing customers with more products and services resulted in the achievement of double-digit increases in operating income and diluted EPS, excluding the prior year gain and related tax benefit."

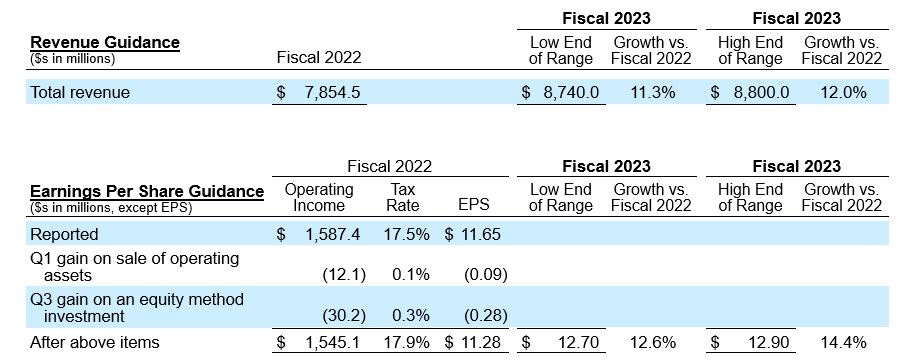

Mr. Schneider concluded, "We are increasing our full fiscal year financial guidance. We are raising our annual revenue expectations from a range of $8.67 billion to $8.75 billion to a range of $8.74 billion to $8.80 billion and diluted EPS from a range of $12.50 to $12.80 to a range of $12.70 to $12.90."

The following table provides a comparison of fiscal 2022 revenue and diluted EPS to our updated fiscal 2023 guidance.

- Fiscal year 2023 operating income is expected to be in the range of $1.77 billion to $1.80 billion compared to $1.55 billion in fiscal year 2022, adjusted to exclude the fiscal 2022 gains in the table above.

- Fiscal year 2023 interest expense is expected to be approximately $112.0 million compared to $88.8 million in fiscal year 2022, due in part to higher interest rates.

- Fiscal year 2023 effective tax rate is expected to be 20.7% compared to a rate of 17.9% in fiscal year 2022, after excluding the fiscal 2022 gains in the table above and their related tax impacts from the reported rate of 17.5%.

- Our diluted EPS guidance includes no future share buybacks.

- We remain in a dynamic environment that can continue to change. Our guidance assumes a stable economy and excludes significant economic disruptions or downturns.

About Cintas Corporation

Cintas Corporation helps more than one million businesses of all types and sizes get Ready™ to open their doors with confidence every day by providing products and services that help keep their customers’ facilities and employees clean, safe and looking their best. With offerings including uniforms, mats, mops, restroom supplies, first aid and safety products, fire extinguishers and testing, and safety training, Cintas helps customers get Ready for the Workday®. Headquartered in Cincinnati, Cintas is a publicly held Fortune 500 company traded over the Nasdaq Global Select Market under the symbol CTAS and is a component of both the Standard & Poor’s 500 Index and Nasdaq-100 Index.

Cintas will host a live webcast to review the fiscal 2023 third quarter results today at 10:00 a.m., Eastern Time. The webcast will be available to the public on Cintas' website at www.Cintas.com. A replay of the webcast will be available approximately two hours after the completion of the live call and will remain available for two weeks.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements. Forward-looking statements may be identified by words such as “estimates,” “anticipates,” “predicts,” “projects,” “plans,” “expects,” “intends,” “target,” “forecast,” “believes,” “seeks,” “could,” “should,” “may” and “will” or the negative versions thereof and similar words, terms and expressions and by the context in which they are used. Such statements are based upon current expectations of Cintas and speak only as of the date made. You should not place undue reliance on any forward-looking statement. We cannot guarantee that any forward-looking statement will be realized. These statements are subject to various risks, uncertainties, potentially inaccurate assumptions and other factors that could cause actual results to differ from those set forth in or implied by this Quarterly Report. Factors that might cause such a difference include, but are not limited to, the possibility of greater than anticipated operating costs including energy and fuel costs; lower sales volumes; loss of customers due to outsourcing trends; the performance and costs of integration of acquisitions; inflationary pressures and fluctuations in costs of materials and labor, including increased medical costs; interest rate volatility; costs and possible effects of union organizing activities; failure to comply with government regulations concerning employment discrimination, employee pay and benefits and employee health and safety; the effect on operations of exchange rate fluctuations, tariffs and other political, economic and regulatory risks; uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation; our ability to meet our goals relating to environmental, social and governance (ESG) opportunities, improvements and efficiencies; the cost, results and ongoing assessment of internal controls for financial reporting; the effect of new accounting pronouncements; disruptions caused by the inaccessibility of computer systems data, including cybersecurity risks; the initiation or outcome of litigation, investigations or other proceedings; higher assumed sourcing or distribution costs of products; the disruption of operations from catastrophic or extraordinary events including global health pandemics such as the COVID-19 coronavirus; the amount and timing of repurchases of our common stock, if any; changes in federal and state tax and labor laws; and the reactions of competitors in terms of price and service. Cintas undertakes no obligation to publicly release any revisions to any forward-looking statements or to otherwise update any forward-looking statements whether as a result of new information or to reflect events, circumstances or any other unanticipated developments arising after the date on which such statements are made. A further list and description of risks, uncertainties and other matters can be found in our Annual Report on Form 10-K for the year ended May 31, 2022 and in our reports on Forms 10-Q and 8-K. The risks and uncertainties described herein are not the only ones we may face. Additional risks and uncertainties presently not known to us, or that we currently believe to be immaterial, may also harm our business.

For additional information, contact:

J. Michael Hansen, Executive Vice President and Chief Financial Officer - 513-972-2079

Paul F. Adler, Vice President - Treasurer & Investor Relations - 513-972-4195